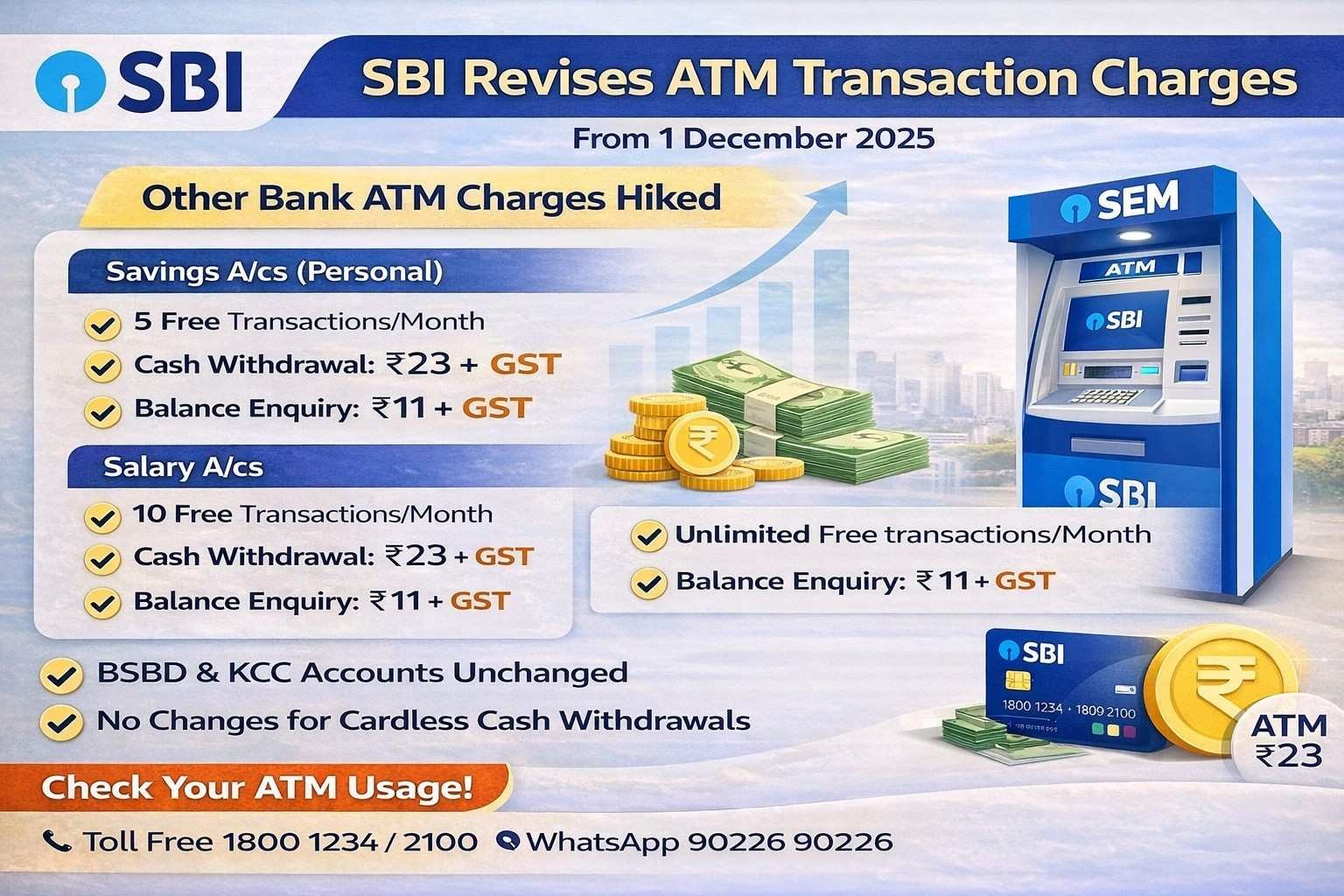

SBI Revises ATM Transaction Charges from 1 December 2025: The State Bank of India (SBI) has announced a revision in ATM and ADWM transaction service charges, which will come into effect from 1 December 2025. The revision applies mainly to SBI debit card holders using ATMs of other banks in India and has been introduced due to an increase in interchange fees.

The revised charges will impact savings account holders, salary account customers, and current account users, while some categories will continue to enjoy free transactions.

Why SBI Has Revised ATM Charges

According to the official notice, ATM transaction charges were last revised in February 2025. Due to an upward revision in interchange fees charged between banks, SBI has decided to revise customer-facing charges for certain ATM transactions at non-SBI ATMs.

Revised ATM Charges for SBI Debit Card Holders (Other Bank ATMs)

- Savings Bank Accounts (Personal Segment)

This applies to all savings accounts excluding BSBD, KCC, and Salary Package accounts.

- Free transactions:

- 5 free transactions per month (financial + non-financial combined)

- No change in free limit

- After free limit:

- Cash withdrawal: ₹23 + GST (earlier ₹21 + GST)

- Non-financial transactions (balance enquiry, mini statement): ₹11 + GST (earlier ₹10 + GST)

- Salary Package Savings Accounts

For all salary account variants, the free transaction limit has been reduced.

- Free transactions:

- Earlier: Unlimited free transactions

- Now: 10 free transactions per month (financial + non-financial combined)

- After free limit:

- Cash withdrawal: ₹23 + GST

- Non-financial transactions: ₹11 + GST

This is a major change for salary account holders who previously enjoyed unlimited free usage at other bank ATMs.

- Current Accounts (Personal & Business)

- Free transactions:

- No free transactions (no change)

- Charges:

- Cash withdrawal: ₹23 + GST

- Non-financial transactions: ₹11 + GST

Reimbursement current accounts linked to salary packages will continue to enjoy free facilities as per existing rules.

Categories Where No Changes Apply (SBI Revises ATM Transaction Charges)

SBI has clarified that no changes will apply to the following categories:

- Basic Savings Bank Deposit (BSBD) Accounts

- Existing free limits will continue

- Kisan Credit Card (KCC) Accounts

- Unlimited free ATM transactions at other bank ATMs will continue

- Transactions at SBI ATMs / ADWMs

- Existing charges remain unchanged

- Cardless Cash Withdrawal

- Unlimited free transactions will continue until further notice

What SBI Customers Should Know

SBI has advised customers to make greater use of its own ATM network, which includes over 63,000 ATMs and ADWMs across India, where non-financial transactions remain free.

Customers can also use alternative banking channels available 24×7:

- Toll-free numbers: 1800 1234 / 1800 2100

- WhatsApp Banking: 90226 90226

- Official Notification: Download

These options help avoid extra ATM charges while accessing basic banking services.

Read More: DRDO HEMRL Internship 2026 | Apply for 40 Intern Posts for Engineering and Science Students